All Categories

Featured

Table of Contents

Interest will be paid from the date of death to date of repayment. If death results from natural reasons, fatality profits will certainly be the return of premium, and interest on the premium paid will certainly go to a yearly effective price defined in the policy contract. Disclosures This plan does not guarantee that its proceeds will certainly suffice to pay for any kind of particular solution or product at the time of need or that services or merchandise will certainly be provided by any kind of certain supplier.

A complete declaration of protection is found just in the policy. For even more details on coverage, expenses, limitations; or to request insurance coverage, speak to a neighborhood State Farm agent. There are restrictions and problems concerning settlement of benefits as a result of misrepresentations on the application. funeral insurance for the elderly. Returns are a return of costs and are based on the real death, cost, and financial investment experience of the Business.

Irreversible life insurance coverage creates money worth that can be borrowed. Plan financings accumulate interest and unsettled plan financings and rate of interest will minimize the death benefit and money value of the policy. The quantity of cash money value available will generally depend on the type of long-term policy purchased, the amount of protection purchased, the size of time the policy has been in force and any impressive policy fundings.

Connect web links for the items on this page are from companions that compensate us (see our marketer disclosure with our list of companions for more details). Nevertheless, our point of views are our own. See exactly how we rate life insurance policy products to create objective product testimonials. Interment insurance policy is a life insurance plan that covers end-of-life expenditures.

Burial insurance policy calls for no clinical exam, making it easily accessible to those with medical conditions. This is where having burial insurance, likewise recognized as final expenditure insurance policy, comes in helpful.

Streamlined issue life insurance calls for a wellness analysis. If your wellness standing invalidates you from standard life insurance policy, interment insurance policy may be an alternative.

Final Expense Life Insurance Rates

, burial insurance comes in numerous forms. This plan is best for those with moderate to modest wellness conditions, like high blood pressure, diabetes, or bronchial asthma. If you don't want a medical test however can certify for a simplified problem plan, it is generally a better bargain than an ensured issue policy due to the fact that you can obtain even more protection for a more affordable costs.

Pre-need insurance coverage is dangerous since the recipient is the funeral chapel and protection is specific to the selected funeral chapel. Should the funeral home go out of organization or you vacate state, you may not have coverage, and that beats the function of pre-planning. Furthermore, according to the AARP, the Funeral Service Consumers Partnership (FCA) discourages acquiring pre-need.

Those are essentially interment insurance policies. For guaranteed life insurance, costs estimations rely on your age, gender, where you live, and insurance coverage amount. Understand that coverage amounts are minimal and differ by insurance policy provider. We found example quotes for a 51-year-woman for $25,000 in insurance coverage living in Illinois: You may choose to pull out of burial insurance if you can or have saved up enough funds to repay your funeral and any type of superior financial debt.

Funeral Cost Insurance Policy

Funeral insurance coverage offers a streamlined application for end-of-life protection. A lot of insurance provider require you to talk to an insurance policy agent to obtain a plan and acquire a quote. The insurance representatives will request your personal info, contact info, economic information, and insurance coverage choices. If you determine to purchase a guaranteed issue life plan, you won't need to undergo a medical examination or questionnaire - affordable death insurance.

The goal of living insurance coverage is to alleviate the problem on your loved ones after your loss. If you have an additional funeral service policy, your liked ones can utilize the funeral policy to take care of last expenditures and get an immediate dispensation from your life insurance policy to take care of the mortgage and education and learning expenses.

People who are middle-aged or older with medical conditions may consider funeral insurance, as they could not certify for standard policies with more stringent approval criteria. Additionally, burial insurance can be practical to those without considerable savings or conventional life insurance coverage. state funeral insurance. Burial insurance varies from various other sorts of insurance policy in that it uses a lower fatality advantage, usually just sufficient to cover costs for a funeral and other linked expenses

ExperienceAlani is a former insurance fellow on the Personal Money Expert team. She's assessed life insurance coverage and animal insurance policy firms and has actually composed many explainers on travel insurance coverage, credit, financial debt, and home insurance coverage.

Georgia Burial Insurance

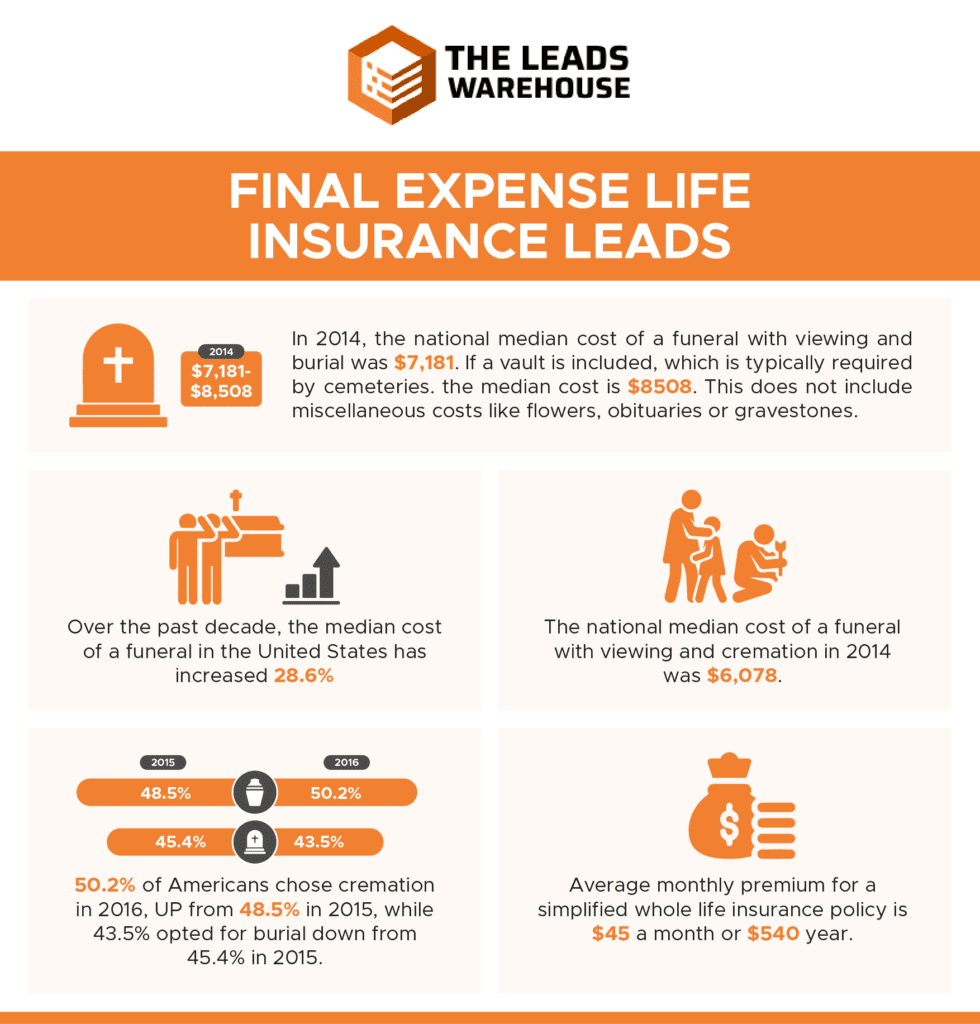

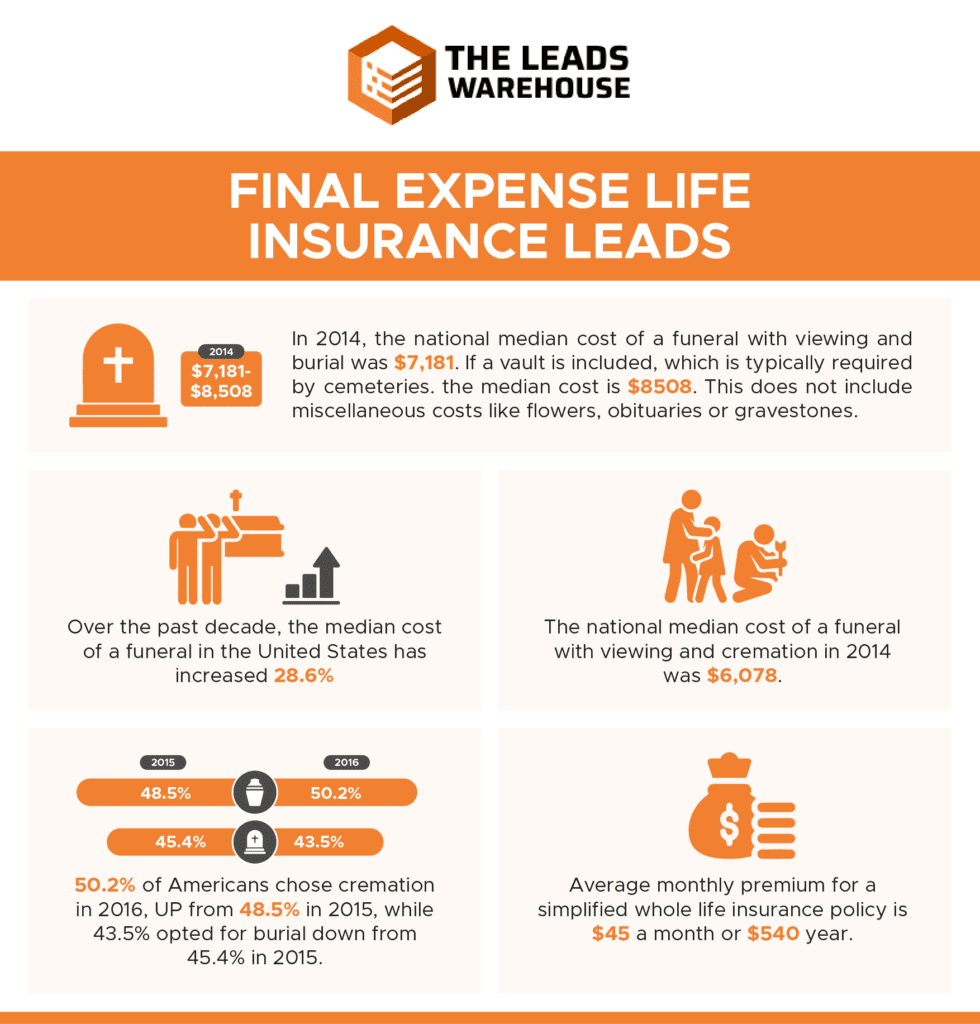

Final expense life insurance has a number of benefits. Last expense insurance coverage is frequently recommended for seniors who may not qualify for standard life insurance coverage due to their age.

Additionally, last expenditure insurance is valuable for individuals who desire to pay for their own funeral service. Burial and cremation services can be pricey, so last cost insurance gives comfort knowing that your liked ones won't have to use their financial savings to spend for your end-of-life setups. Final expenditure protection is not the best product for everyone.

You can have a look at Ethos' overview to insurance coverage at different ages (funeral final expense insurance) if you require help choosing what type of life insurance policy is best for your stage in life. Getting entire life insurance policy with Ethos is quick and very easy. Protection is offered for seniors in between the ages of 66-85, and there's no medical examination needed.

Based on your actions, you'll see your approximated rate and the amount of coverage you get approved for (between $1,000-$ 30,000). You can acquire a policy online, and your coverage begins quickly after paying the first premium. Your price never ever alters, and you are covered for your entire lifetime, if you continue making the monthly repayments.

Difference Between Life And Funeral Cover

Last expenditure insurance policy uses benefits but requires mindful factor to consider to determine if it's best for you. Life insurance policy can deal with a selection of monetary requirements. Life insurance policy for final expenses is a sort of long-term life insurance policy developed to cover costs that develop at the end of life - final expense insurance imo. These plans are relatively simple to get, making them perfect for older individuals or those that have health issues.

According to the National Funeral Directors Association, the ordinary cost of a funeral with funeral and a watching is $7,848.1 Your loved ones might not have accessibility to that much money after your death, which might include in the stress they experience. In addition, they may experience other expenses associated with your passing.

Last cost coverage is occasionally called burial insurance, but the money can pay for essentially anything your loved ones require. Recipients can make use of the death advantage for anything they need, permitting them to attend to the most pressing economic priorities.

: Hire specialists to help with managing the estate and browsing the probate process.: Liquidate accounts for any type of end-of-life treatment or care.: Repay any kind of various other financial obligations, consisting of automobile fundings and debt cards.: Recipients have complete discernment to make use of the funds for anything they need. The cash can also be used to create a tradition for education and learning costs or contributed to charity.

Table of Contents

Latest Posts

Best Burial Plans

All Life Funeral Policy

Funeral Costs Insurance Plans

More

Latest Posts

Best Burial Plans

All Life Funeral Policy

Funeral Costs Insurance Plans